dependent care fsa eligible expenses

You bought new eyeglasses squeaked in a dental appointment and stocked up on over-the-counter drugs. Qualified dependent care expenses To be considered qualified dependents must meet the following criteria.

Its the care your family needs while youre at work.

. They include the following. The cost of routine skin care face creams etc does not qualify. The Only One-Stop-Shop Stocked Exclusively With FSA-Eligible Products.

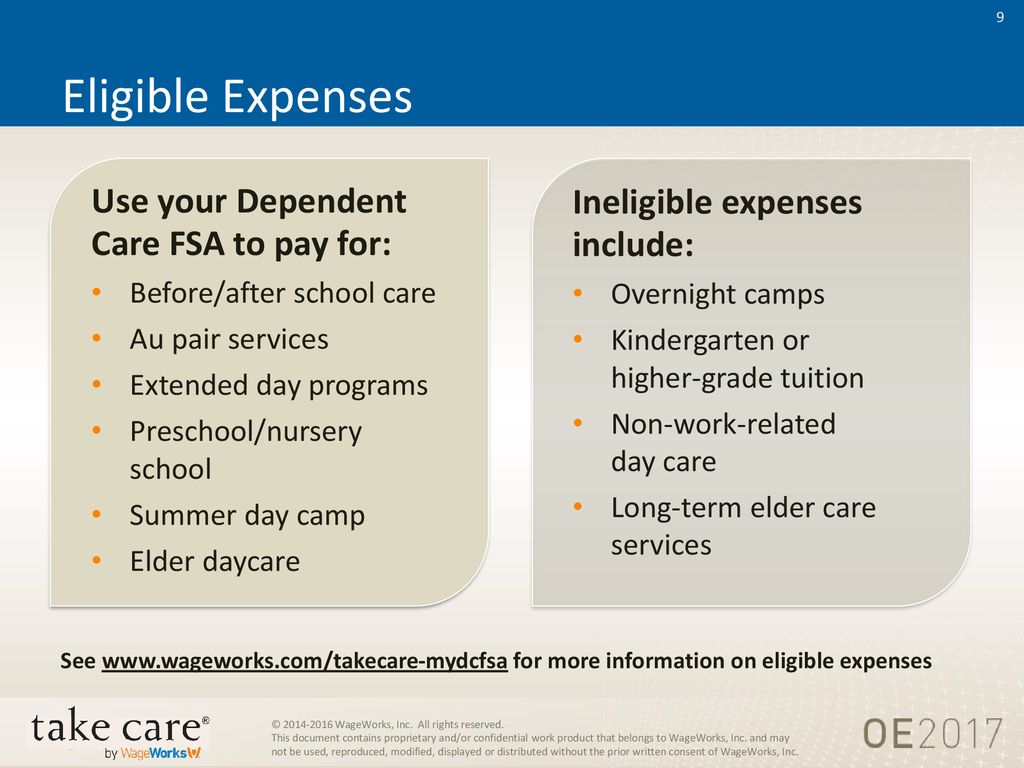

Licensed nursery schools Qualified childcare centers Adult day care facilities After school programs Summer camps for dependent children under age 13 Preschool tuition This list is not meant to be all-inclusive. The 2021 dependent-care fsa contribution limit was increased by the american rescue plan act to 10500 for single filers and couples filing jointly up from 5000 and 5250 for married couples. Employers may offer these limits but are not required to.

The following lists are not all-inclusive. Your family is completely taken care of while youre busy on the job. When the expense has both medical and cosmetic purposes eg Retin-A which can be used to treat both acne and wrinkles a note from a medical practitioner recommending the item to treat a specific medical condition is required.

This account follows the popular use-it-or-lose-it rules like other FSAs. Dependent care FSA-eligible expenses include. Expenses for services provided by a dependent care center including a day camp that complies with all applicable state and local laws and regulations.

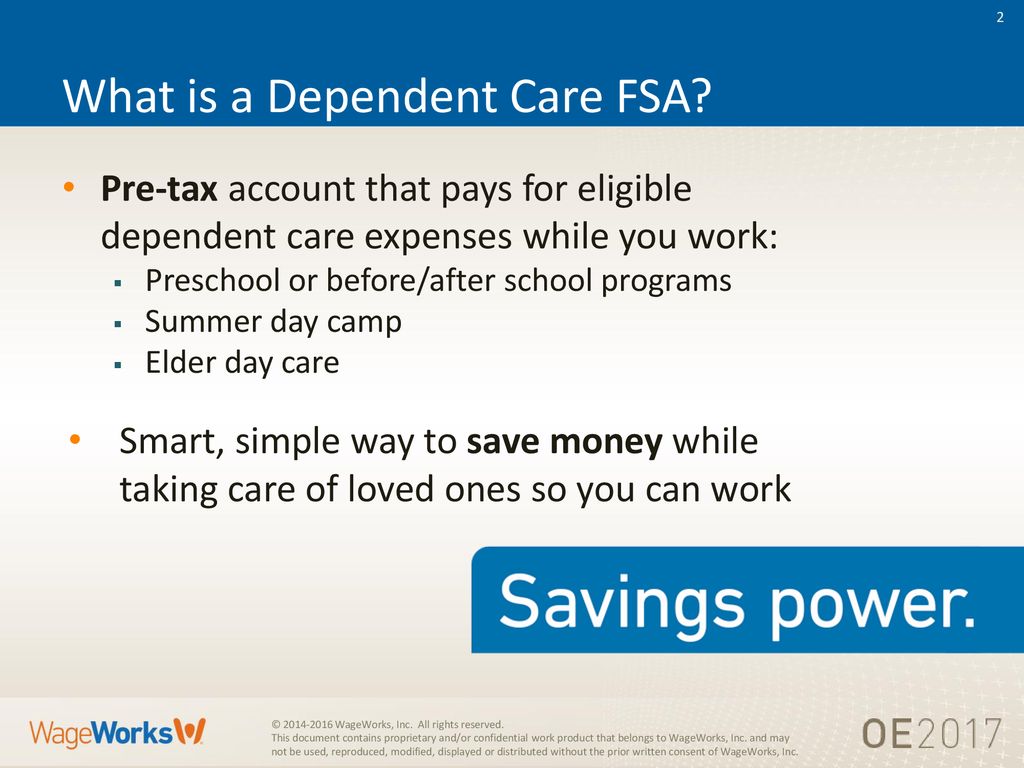

Use the money to care for your family Like other FSAs the dependent care FSA allows you to fund your account with pretax dollars. 37 FSA eligible items to spend your FSA dollars on. The IRS determines which expenses are eligible for reimbursement.

For 2021 the credit figured on Form 2441 Child and Dependent Care Expenses line 9a is unavailable for any taxpayer with adjusted gross income over 438000. Dependent Care FSA Eligible Expenses You can use your Dependent Care FSA to pay for a huge variety of child and elder care services. The money you contribute to your DCFSA can reduce your taxable income but you must use the funds within a certain period of time.

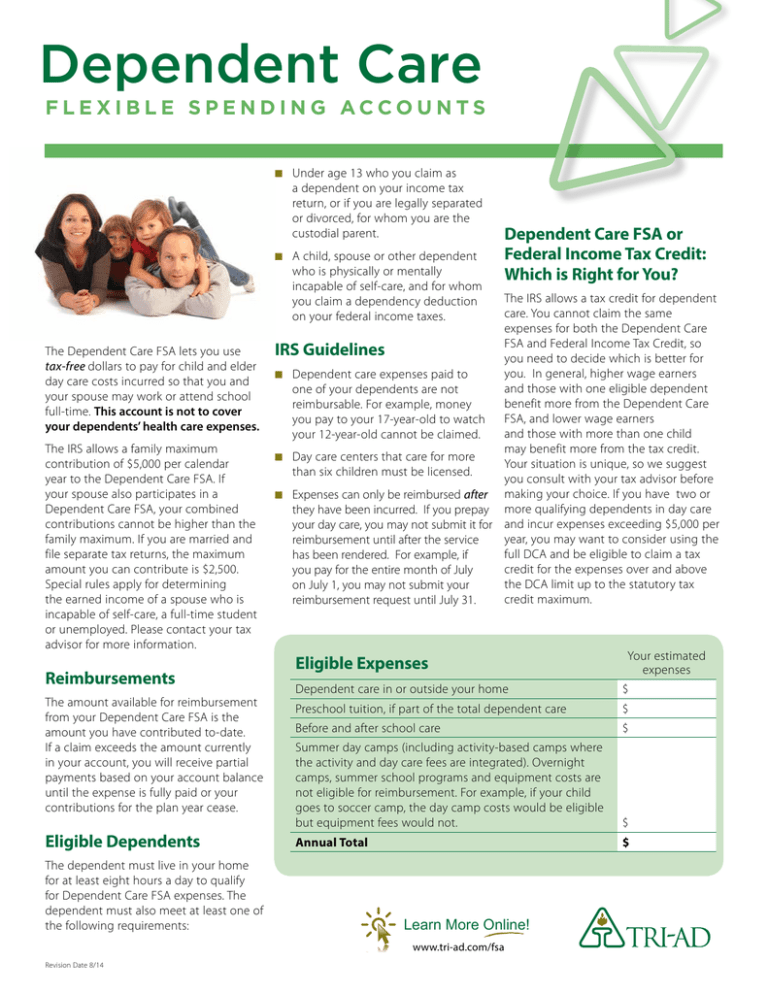

A dependent care flexible spending account covers qualified day care expenses for children younger than age 13 and adult dependents who are incapable of caring for themselves. For a complete list of qualified dependent care expenses see IRS Publication 503. A dependent care FSA DCFSA provides tax savings for the care of your children a disabled spouse or legally dependent parent during your working hours.

Child and dependent care expenses may be refundable for 2021 later. While this list identifies the eligibility of some of the most common dependent care expenses its not meant to be comprehensive. In these cases nannies meet the essential qualifying criteria and charges easily exceed the 5000 limit.

This applies even if the camp specializes in sports ie basketball volleyball etc or computers. Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. Download flyer Related resources.

Learn more about how much you can save what it covers and how to get started today. Medical FSA HRA HSA. Fast and simple reimbursement.

That means for a married couple each parent can contribute 2500 to their own Dependent Care FSA for a total of 5000. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing separately. Parents can use their Dependent Care FSA to cover nanny expenses provided they care for young children in the home so that both parents can work.

For married couples who file taxes separately the 2022 limit is 2500 per person per year. A dependent care FSA allows individuals to use pretax dollars to pay for qualified dependent care expenses. Employers can choose whether to adopt the increase or not.

Dependent Care FSA Eligible Expenses Care for your child who is under age 13. Ever you may still be eligible to claim a credit on Form 2441 line 9b for 2020 expenses paid in 2021. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500.

But if theres still money in your. All claimed expenses need to be related to care for the dependent because theyre the ones that allow you. For 2022 and beyond the limit will revert to 5000.

The Internal Revenue Service IRS decides which expenses can be paid from an FSA and they can modify the list at any time. By putting that money aside pre-tax in a dependent care FSA rather than allowing the funds to be taxed you save nearly 1500 this year. Eligible dependent care expenses.

If youre enrolled in a dependent care flexible spending account DCFSA you can use your pre-tax funds to cover expenses for your childdependent under the age of 13 as well as adult dependents based on dependents you claim on your tax returns for dependent care while you or your spouse work or look for work. Day camp expenses are eligible for reimbursement from a Dependent Care FSA as long as they provide custodial care for children under the age of 13 so the parent s can work look for work or attend school full-time. However you may still be eligible to claim a credit on Form 2441 line 9b for 2020 expenses paid in 2021.

Children under the age of 13 A spouse who is physically or mentally unable to care for himherself Any adult you can claim as a dependent on your tax return that is physically or mentally unable to care for himherself Eligible expenses. With a Dependent Care FSA you use pre-tax dollars to pay qualified out-of-pocket dependent care expenses. However keep in mind that by claiming an at-home nanny you then become a household employer.

This document can be used to help you determine which expenses may be eligible for reimbursement under your Health Care or Dependent Care Flexible Spending Account FSA. The money you contribute to a Dependent Care FSA is not subject to payroll taxes so you end up paying less in taxes and taking home more of your paycheck. In order to claim reimbursement for elder care expenses your dependent elder must live with you for at least eight hours a day and they must be claimed as a dependent on your annual tax returns.

This includes preschool nursery school day care before and after school care and summer day camp. Common qualified expenses that a health care FSA will usually cover include the deductible coinsurance or copayment amounts for your health plan eye glasses or contact lenses dental work and orthodontia medical equipment hearing aids and chiropractic care. And frequently asked questions at.

But this account is for eligible child and adult care expenses. Before school or after school care other than tuition Qualifying custodial care for dependent adults Licensed day care centers Nursery schools or pre-schools Placement fees for a dependent care provider such as an au pair. Eligible Dependent Care FSA Expenses Eligible expenses are defined as those that enable you and your spouse if any to be gainfully employed or to seek employment.

The Instructions for Form 2441 available at IRSgovForm2441. Ad Shop The Largest Selection Of FSA-Eligible Products Today And Get Free Shipping 50. The IRS has outlined a list of Dependent Care FSA eligible expenses.

Over-the-counter drugs such as cold and allergy medicines pain relievers and. Dependent care FSA-eligible expenses include. They must also be incapable of self-care.

Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars.

Dependent Care Fsa Babysitter Receipt Fill Online Printable Fillable Blank Pdffiller

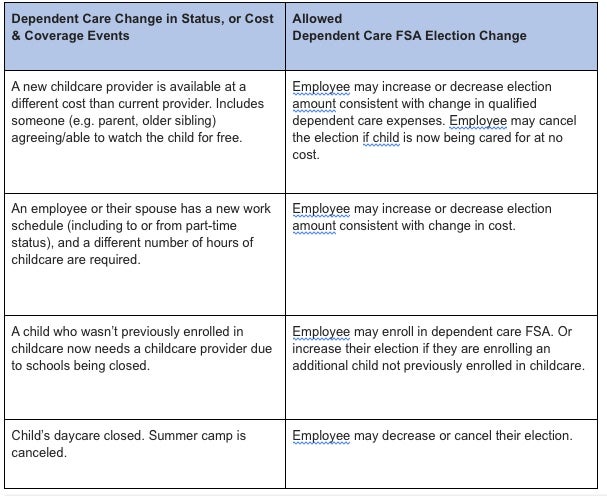

Dependent Care Open Enrollment 24hourflex

Dependent Care Fsa Flexible Spending Account Ppt Download

Your Flexible Spending Account Fsa Guide

Flexible Spending Accounts Fsa 2020

Dependent Care Flexible Spending Accounts Flex Made Easy

Why You Should Consider A Dependent Care Fsa

Dependent Care Fsa Flexible Spending Account Ppt Download

How To File A Dependent Care Fsa Claim 24hourflex

Using Your Dependent Care Fsa To Pay For Daycare Quality For Kids

Your Handy List Of Fsa Eligible Expenses Employers Resource

What Is A Dependent Care Fsa Wex Inc

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

Coh Dependent Care Reimbursement Plan

Flexible Spending Accounts What Are They How Do They Work How Can I Enroll For 2014 Pdf Free Download

File A Dca Claim American Fidelity

Health Care And Dependent Care Fsas Infographic Optum Financial